madison county property taxes

If you have questions or comments please call our office. Welcome to Madison County Missouri Government.

|

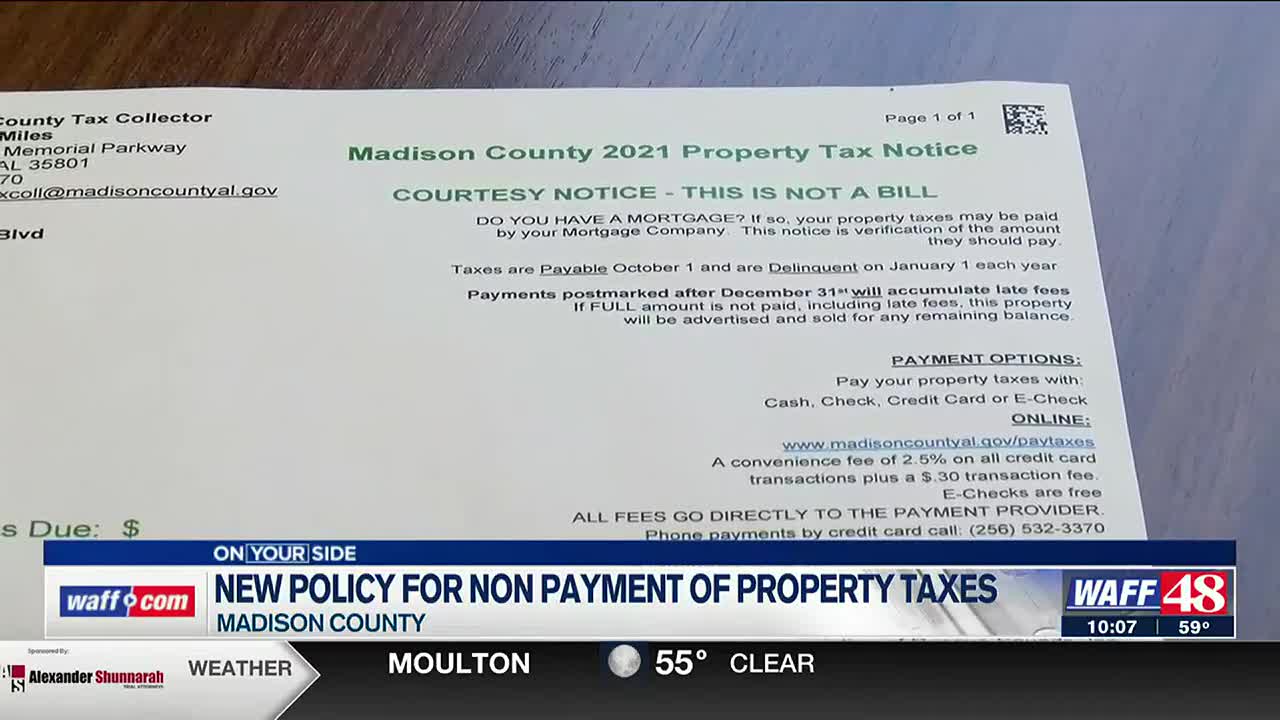

| Madison Co Tax Collector Sends Out Reminder For Property Taxes Includes New Policy For Non Payment |

If the taxable value of a property is 75000 and the taxing authoritys millage rate is 72 mills then the taxes due would be calculated as follows.

. We are very proud to offer this as a source of information for the tax payer and encourage you to use this for your convenience. Named after James Madison 4th President of the United States Madison County is located in central. Real and Personal Property Taxes. The purpose of this web site is to provide you with answers to questions we are asked many times during the year.

Madison County is one of the fastest growing counties in Mississippi yet we have sought to remain a small friendly community full of rich history and looking forward to a bright future. The information is uploaded to this server frequently but may lag behind actual activity in the office. This web site will also acquaint you with Alabama Law concerning property tax. Use the links at the left to find out information about your elected officials and their roles.

Madison County Missouri Goverment. Welcome to Madison County OH. The median property tax in Madison County Indiana is 913 per year for a home worth the median value of 96300. You can now look up the amount of tax due on your real estate property or your business tangible property.

In Madison County the responsibility to assess and collect taxes is handled by two offices a tax assessor and tax collector. Madison County COVID-19 Bulletin. There is no fee for using a checking or savings account. Effective tax rate Madison County.

Welcome to the Madison County Alabama online tax record search. Search Property Tax Bills. Please use the Search feature to find your property of interest. Directions to MC Offices.

00093 of Asessed Home Value. Thank you for visiting our website. The historic towns of Fredericktown and Marquand offer a unique experience to adventurers in Madison County Missouri. 00085 of Asessed Home Value.

Real Estate taxes can be paid in full to the City by January 31 or can be paid in four installments. Welcome to the Madison County Assessors Office real property records online. The Tax Collector collects all ad valorem taxes levied in Polk County. There is a fee for using a credit or debit card.

Indiana is ranked 1641st of the 3143 counties in the United States in order of the median amount of property taxes collected. Board of Elections Website. Pay Tickets read more Pay Taxes read more Property Search read more Court Record Search read more Pay Utilities read more. Use the links at the left to find out information about your elected officials and their roles.

Madison County is one of the fastest growing counties in Mississippi yet we have sought to remain a small friendly community full of rich history and looking forward to a bright future. Explore the charts below for quick facts on Madison County effective tax rates median real estate taxes paid home values income levels and homeownership rates and compare them to state and nationwide trends. The Monroe County Tax Collector also accepts partial payments with a signed affidavit found on the back of the tax bill or contact our office at 305 295-5070 for a copy of the affidavit per Florida Statute 197374. Welcome to Madison County Ohio.

Madison County Code of Ordinances. Tax bills for personal property are based on. 75 x 72 mills 540 in City Taxes Due. Madison County Storm Water Information.

Your source for Official Madison County Government Information. To begin your search choose the link below. As the Assessor of Property I am required to locate classify and appraise all taxable property according to the laws of the State of Tennessee. We will process all tax payments postmarked on or before December 31 2021 as having been paid in 2021.

Home Conrad Hake 2020-03-01T153813-0600. Madison County collects on average 095 of a propertys assessed fair market value as property tax. Madison County Courthouse 100 North Side Square. Welcome to the Madison Sheriffs Office Property Tax Search page.

Pay Property Taxes Online. The Assessor of Propertys Office is located on the third 3rd floor of the Madison County Courthouse. The Assessor of Property is not responsible for setting the tax rate or collecting taxes. WHY DID I RECEIVE THIS BILL.

Taxable Property Value of 75000 1000 75. The Madison County Treasurer is the general tax collector custodian and investor for Madison County. Search Property Tax Information. Discounts are extended for early payment.

Ad Valorem taxes on real property are collected by. The Tax Collector also. January 31 March 31 May 31 and July 31. This search engine will return property tax information of record in Madison County.

Madison County Sheriffs Office. Our office hours are 830 am - 500 pm. Madison County Stats for Property Taxes. Our area features a perfect blend of rolling.

Board of Assessors Notice to Property Owners. Our office can assist you with making payments determining your balance due obtaining mobile home transfer permits and answering any questions about past taxes. The property owner must agree to and understand the following.

|

| Pdf Issue Pencitycurrent Com In 2021 Google Play Apps Lee County Danville |

|

| Where To Find Pre Foreclosures And Foreclosures Mls Redx Zillow Foreclosure Com Hudhomestore Com Public Records Through Madi Foreclosures Pre Home Buying |

|

| Cctv Cameras Per 1000 People Oc Dataisbeautiful Information Visualization Cctv Camera Data Visualization |

|

| Pin On Brazil |

|

| Years Of Income Needed To Pay Off A House Data Interestingdata Beautifuldata Visualdata Kings County Map Information Visualization |

Posting Komentar untuk "madison county property taxes"